utah restaurant food tax rate

Both food and food ingredients will be taxed at a reduced rate of 175. The restaurant tax applies to all food sales both prepared food and grocery food.

Utah Lawmakers And Community Members Want To End The Sales Tax On Food Items Kuer

Depending on which county the business is located in the restaurant tax in Utah can range from 610 to 1005.

. The Box Elder County Utah sales tax is 595 the same as the Utah state sales tax. To find out what the rate is in your. 2022 Utah state sales tax.

Restaurants must also collect a 1 percent restaurant tax on all food and beverage sales. There are a total of 131 local tax. Report and pay this tax using form TC-62F Restaurant Tax Return.

93 rows The entire combined rate is due on all taxable transactions in that tax jurisdiction. However in a bundled transaction which involves both food. January 1 2018 December 31 2021.

Utahs sales tax rates for commonly exempted categories are. In the state of Utah the foods are subject to local taxes. January 1 2022 current.

While many other states allow counties and other localities to collect a local option sales tax Utah does not. Both food and food ingredients will be taxed at a reduced rate of 175. However in a bundled transaction which.

Utah has state sales tax of 485 and. The state provides a guidance page with plenty of examples on what is and what is not. 271 rows Average Sales Tax With Local6964.

Utah has a single tax rate for all income levels as follows. Exact tax amount may vary for different items. Utah specifies that prepared food is considered ready to eat or sold with utensils.

Utah Restaurant Tax. Depending on which county the business is located in the restaurant tax in Utah can range from 610 to 1005. In the state of Utah the foods are subject to local taxes.

Both food and food ingredients will be taxed at a reduced rate of 175. The Utah state sales tax rate is 595 and the average UT sales tax after local surtaxes is 668.

Washington Sales Tax For Restaurants Sales Tax Helper

Looking Back At The Interesting History Of Utah S Sales Tax Ksl Com

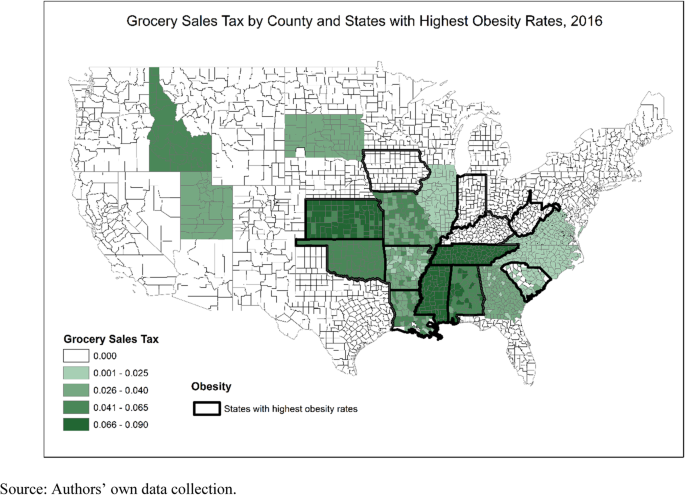

Grocery Food Taxes And U S County Obesity And Diabetes Rates Health Economics Review Full Text

Everything You Need To Know About Restaurant Taxes

Sales Taxes In The United States Wikiwand

Utah Lawmakers Are Discussing An Increased Tax On Food Here S What That Means Kutv

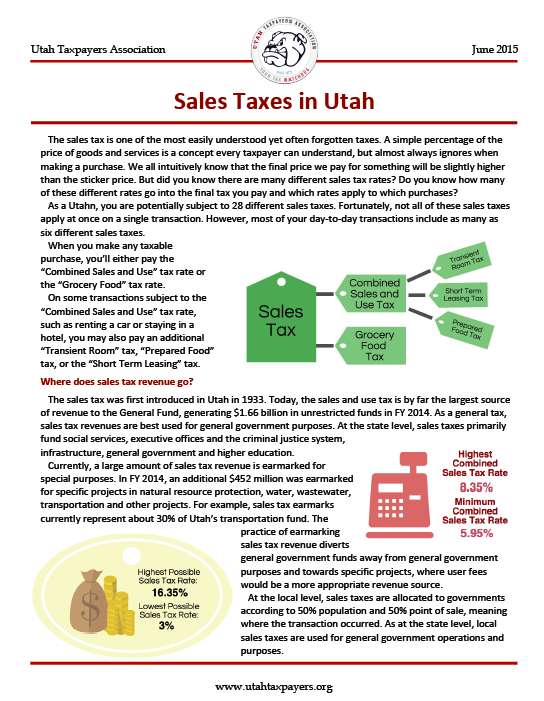

Sales Taxes In Utah A New Report From The Utah Taxpayers Association Utah Taxpayers

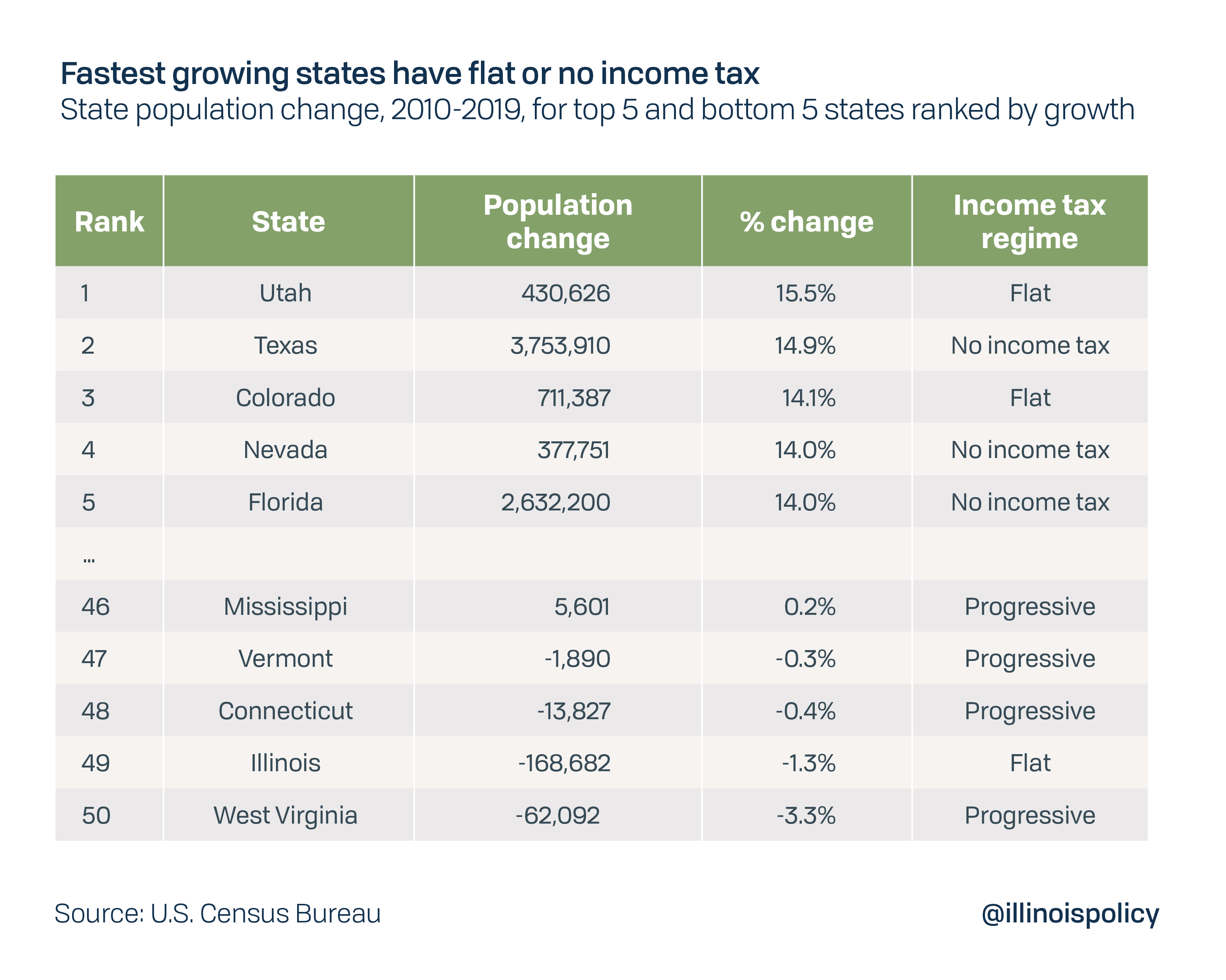

Every State With A Progressive Tax Also Taxes Retirement Income

Utah Lawmakers Are Discussing An Increased Tax On Food Here S What That Means Kutv

Utah 2022 Sales Tax Calculator Rate Lookup Tool Avalara

What Are The Food Perks At Your Work These Utah Companies Have Free Lunch Food Truck Events And A Treat Trolley To Keep Employees Happy Productive And Yes Fed

State And Local Sales Tax Rates Midyear 2021 Tax Foundation

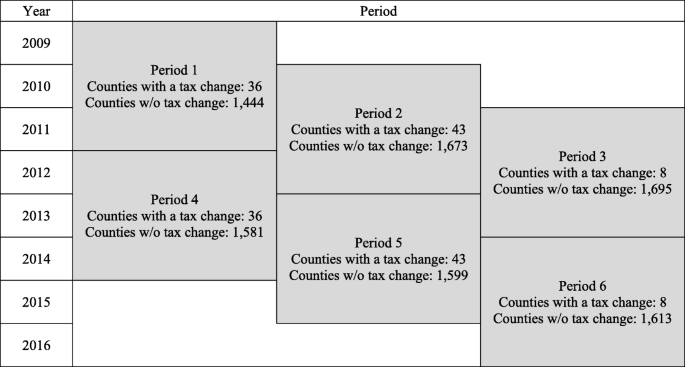

Grocery Food Taxes And U S County Obesity And Diabetes Rates Health Economics Review Full Text

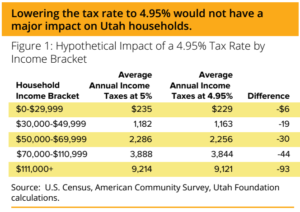

Considering A Cut To Utah S Income Tax Utah Foundation

Sales Tax By State To Go Restaurant Orders Taxjar

How Do State And Local Sales Taxes Work Tax Policy Center

Historical Utah Tax Policy Information Ballotpedia

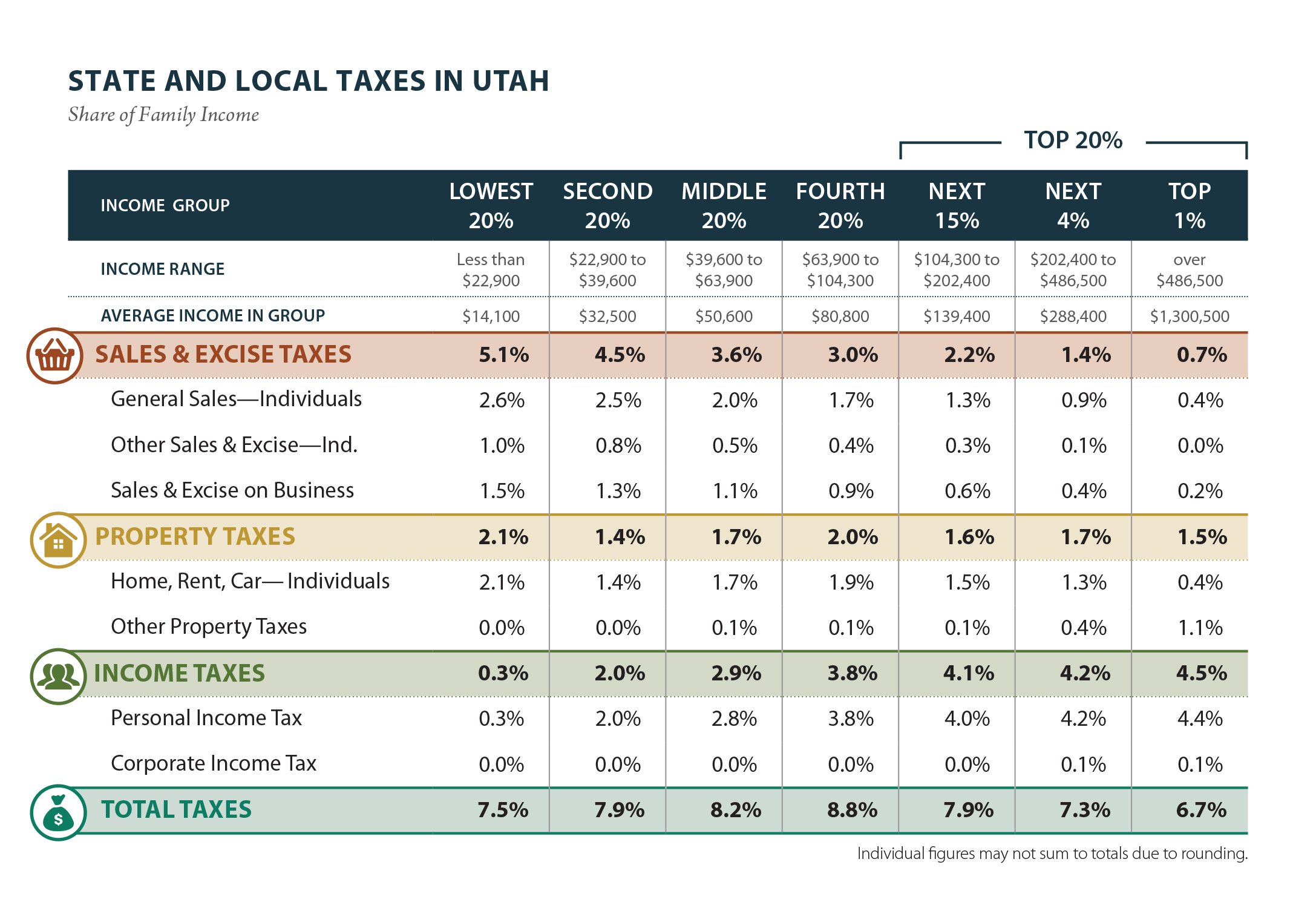

Utah Who Pays 6th Edition Itep

Utah Lawmakers Are Discussing An Increased Tax On Food Here S What That Means Kutv